Positive outcome of SeaZip Bonds issuance signals investor confidence

All SeaZip Bonds have been placed in less than two months, raising €6 million. Although the refinancing for the four SeaZip ships was not urgent—the existing ship financing ran until January 2025—the JR Shipping shipping group looks back with satisfaction on the decision to ensure a solid and long-term financial foundation under the ships at this time.

This continuity is crucial right now. The activity level in the offshore wind industry is currently at its highest. Especially in the North Sea, work is underway on the development and realization of prestigious wind turbine projects and infrastructure facilities aimed at making the North Sea the world’s largest sustainable power plant. The demand for service ships like those of SeaZip – Crew Transfer vessels– continues to increase.

Europe is accelerating with wind from the sea

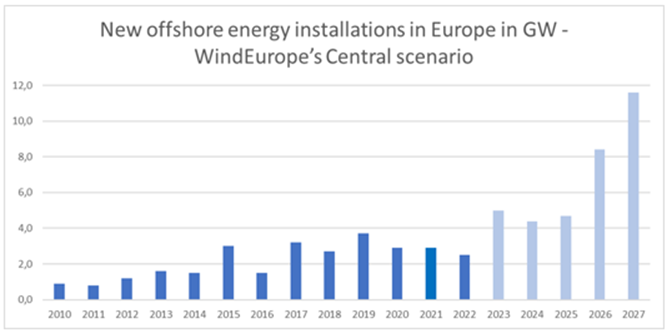

The progress that Europe is making with sustainable energy from wind at sea has multiple drivers. First and foremost are the binding climate agreements from the 2015 Paris Climate Accord. Wind at sea plays a vital role in reducing CO2. Due to recent geopolitical unrest and the associated energy crisis, factors such as the sustainability of the energy supply, independence from existing sources, and supply security are even higher on the agenda. The EU is committed to a substantial deployment of offshore wind, resulting in promising prospects for the field in which SeaZip operates. The graph below illustrates the development well.

Source: WindEurope, February 28, 2023

Added value through double capacity

SeaZip Offshore Service has been active since 2010 and has gradually expanded its fleet since then, with the purchase of an existing ship, renamed SeaZip 9, as the most recent achievement. SeaZip 3 to 6 have been part of the fleet since early 2015 and 2016. They were built by Damen Shipyards. In 2022, the capacity of the Crew Transfer vessels was doubled from 12 to 24 passengers (PAX). Precisely 24 PAX ships are highly sought after within the offshore wind industry.

Sailing for wind at sea

The first mortgage and the high annual interest rate of 7.5%, payable quarterly, were, of course, significant reasons to subscribe to SeaZip Bonds. However, it turns out that investors also recognize themselves in the sustainable dimension of SeaZip Bonds. SeaZip’s 24 PAX ships sail for sustainable wind at sea. Investors and bondholders sail sustainably with them!